Home Office Deduction Employe . Web as an employee, you can deduct the additional running costs and phone and internet expenses you incur as a result of working from home. Home office equipment, including computers, printers and telephones. The rate includes the additional running. Running expenses and occupancy expenses. Web you can claim 67 c for each hour you work from home during the relevant income year. Calculating working from home tax deductions. Web running expenses such as: You can't claim occupancy expenses. You can claim running expenses. Web to calculate your deduction for working from home expenses, you must use one of the methods set out below. Web you can claim a fixed rate of 67 cents for each hour you work from home. You can claim the full cost (for. Web home office tax deductions cover the cost of working from home and are split into two broad categories: Tailored contracts & docsadvice for employers Web as an employee working from home, generally:

from www.template.net

Web you can claim 67 c for each hour you work from home during the relevant income year. Running expenses and occupancy expenses. In australia, you can calculate these deductions using a fixed rate or actual. Web as an employee, you can deduct the additional running costs and phone and internet expenses you incur as a result of working from home. You can't claim occupancy expenses. Home office equipment, including computers, printers and telephones. Calculating working from home tax deductions. Web to calculate your deduction for working from home expenses, you must use one of the methods set out below. Tailored contracts & docsadvice for employers The rate includes the additional running.

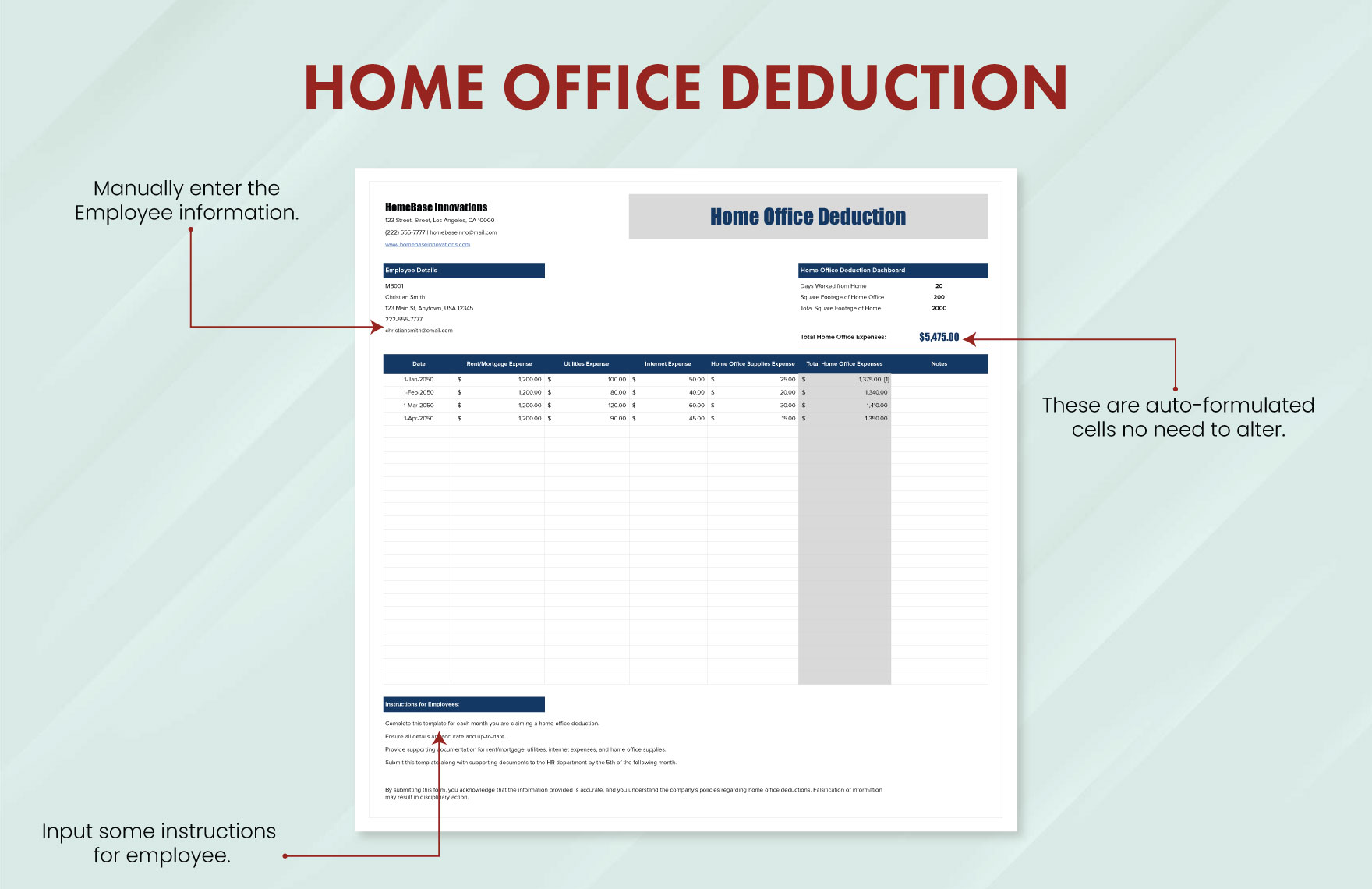

Home Office Deduction Template in Excel, Google Sheets Download

Home Office Deduction Employe You can't claim occupancy expenses. Web to calculate your deduction for working from home expenses, you must use one of the methods set out below. Web as an employee, you can deduct the additional running costs and phone and internet expenses you incur as a result of working from home. In australia, you can calculate these deductions using a fixed rate or actual. Web home office tax deductions cover the cost of working from home and are split into two broad categories: Web as an employee working from home, generally: The rate includes the additional running. Web running expenses such as: You can't claim occupancy expenses. Running expenses and occupancy expenses. Home office equipment, including computers, printers and telephones. Tailored contracts & docsadvice for employers Web you can claim 67 c for each hour you work from home during the relevant income year. Calculating working from home tax deductions. You can claim running expenses. You can claim the full cost (for.

From www.slideserve.com

PPT Chapter 8 Employee Business Expense PowerPoint Presentation, free Home Office Deduction Employe The rate includes the additional running. Web you can claim a fixed rate of 67 cents for each hour you work from home. You can't claim occupancy expenses. Running expenses and occupancy expenses. Web as an employee, you can deduct the additional running costs and phone and internet expenses you incur as a result of working from home. Web as. Home Office Deduction Employe.

From hobe.com

Home Office Deductions More Complex Than They Seem Hobe & Lucas Home Office Deduction Employe Web running expenses such as: Tailored contracts & docsadvice for employers Calculating working from home tax deductions. Running expenses and occupancy expenses. Web as an employee working from home, generally: You can claim the full cost (for. Web you can claim 67 c for each hour you work from home during the relevant income year. You can claim running expenses.. Home Office Deduction Employe.

From www.stkittsvilla.com

A Singaporean S Guide How To Claim Tax Deduction For Work Home Office Deduction Employe You can claim the full cost (for. Web running expenses such as: Home office equipment, including computers, printers and telephones. Web to calculate your deduction for working from home expenses, you must use one of the methods set out below. Web home office tax deductions cover the cost of working from home and are split into two broad categories: Running. Home Office Deduction Employe.

From epicofficefurniture.com.au

5 Home Office Deductions You Should Know About Epic Office Furniture Home Office Deduction Employe Web running expenses such as: Web as an employee, you can deduct the additional running costs and phone and internet expenses you incur as a result of working from home. Web you can claim 67 c for each hour you work from home during the relevant income year. Running expenses and occupancy expenses. Web you can claim a fixed rate. Home Office Deduction Employe.

From abzlocal.mx

Top 67+ imagen home office deduction for employee Abzlocal.mx Home Office Deduction Employe The rate includes the additional running. Web as an employee working from home, generally: Home office equipment, including computers, printers and telephones. Web running expenses such as: Web you can claim a fixed rate of 67 cents for each hour you work from home. In australia, you can calculate these deductions using a fixed rate or actual. You can't claim. Home Office Deduction Employe.

From www.superfastcpa.com

What is the Home Office Deduction? Home Office Deduction Employe Home office equipment, including computers, printers and telephones. Tailored contracts & docsadvice for employers You can claim running expenses. Web running expenses such as: Web to calculate your deduction for working from home expenses, you must use one of the methods set out below. In australia, you can calculate these deductions using a fixed rate or actual. Running expenses and. Home Office Deduction Employe.

From www.stkittsvilla.com

Can You Take A Home Office Tax Deduction Virblife Com Home Office Deduction Employe You can't claim occupancy expenses. Running expenses and occupancy expenses. You can claim running expenses. In australia, you can calculate these deductions using a fixed rate or actual. Web home office tax deductions cover the cost of working from home and are split into two broad categories: Web you can claim a fixed rate of 67 cents for each hour. Home Office Deduction Employe.

From turbotax.intuit.com

The Home Office Deduction TurboTax Tax Tips & Videos Home Office Deduction Employe Web you can claim 67 c for each hour you work from home during the relevant income year. You can claim running expenses. Web home office tax deductions cover the cost of working from home and are split into two broad categories: Web as an employee working from home, generally: Web as an employee, you can deduct the additional running. Home Office Deduction Employe.

From www.patriotsoftware.com

Home Office Tax Deduction Deduction for Working from Home Home Office Deduction Employe Web you can claim a fixed rate of 67 cents for each hour you work from home. In australia, you can calculate these deductions using a fixed rate or actual. Web home office tax deductions cover the cost of working from home and are split into two broad categories: Calculating working from home tax deductions. The rate includes the additional. Home Office Deduction Employe.

From alloysilverstein.com

Making Your Home Office a Tax Deduction Alloy Silverstein Home Office Deduction Employe Calculating working from home tax deductions. Web to calculate your deduction for working from home expenses, you must use one of the methods set out below. Web running expenses such as: You can't claim occupancy expenses. Web as an employee, you can deduct the additional running costs and phone and internet expenses you incur as a result of working from. Home Office Deduction Employe.

From welchllp.com

CRA Guidance on Employee Home Office Expenses Deduction on 2020 T1 due Home Office Deduction Employe Web running expenses such as: You can claim the full cost (for. Web home office tax deductions cover the cost of working from home and are split into two broad categories: Web as an employee, you can deduct the additional running costs and phone and internet expenses you incur as a result of working from home. Calculating working from home. Home Office Deduction Employe.

From abzlocal.mx

Top 67+ imagen home office deduction for employee Abzlocal.mx Home Office Deduction Employe Tailored contracts & docsadvice for employers The rate includes the additional running. Web you can claim 67 c for each hour you work from home during the relevant income year. In australia, you can calculate these deductions using a fixed rate or actual. You can claim running expenses. Calculating working from home tax deductions. Home office equipment, including computers, printers. Home Office Deduction Employe.

From www.flexjobs.com

Guide to Understanding Home Office Deductions FlexJobs Home Office Deduction Employe Web as an employee working from home, generally: Web home office tax deductions cover the cost of working from home and are split into two broad categories: Web to calculate your deduction for working from home expenses, you must use one of the methods set out below. You can claim running expenses. Tailored contracts & docsadvice for employers In australia,. Home Office Deduction Employe.

From www.template.net

Home Office Deduction Template in Excel, Google Sheets Download Home Office Deduction Employe Web to calculate your deduction for working from home expenses, you must use one of the methods set out below. Web you can claim 67 c for each hour you work from home during the relevant income year. Web home office tax deductions cover the cost of working from home and are split into two broad categories: Web you can. Home Office Deduction Employe.

From pruscpa.com

HomeOffice Deduction News & Updates » GP CPA Charlotte, NC Home Office Deduction Employe The rate includes the additional running. Web as an employee, you can deduct the additional running costs and phone and internet expenses you incur as a result of working from home. Running expenses and occupancy expenses. Web you can claim a fixed rate of 67 cents for each hour you work from home. In australia, you can calculate these deductions. Home Office Deduction Employe.

From www.youtube.com

The Ultimate Guide to Home Office Deductions for Tax Savings YouTube Home Office Deduction Employe Web as an employee working from home, generally: Tailored contracts & docsadvice for employers You can't claim occupancy expenses. Web to calculate your deduction for working from home expenses, you must use one of the methods set out below. You can claim the full cost (for. Running expenses and occupancy expenses. Home office equipment, including computers, printers and telephones. Web. Home Office Deduction Employe.

From shunshelter.com

Simplified Home Office Deduction An Employee's Guide ShunShelter Home Office Deduction Employe Web as an employee, you can deduct the additional running costs and phone and internet expenses you incur as a result of working from home. Web to calculate your deduction for working from home expenses, you must use one of the methods set out below. Web you can claim 67 c for each hour you work from home during the. Home Office Deduction Employe.

From www.youtube.com

Can you deduct a HOME OFFICE? Deductions & COVID19 Work Home Office Deduction Employe You can claim running expenses. Web running expenses such as: Running expenses and occupancy expenses. Home office equipment, including computers, printers and telephones. Calculating working from home tax deductions. Web as an employee working from home, generally: Web you can claim a fixed rate of 67 cents for each hour you work from home. Web as an employee, you can. Home Office Deduction Employe.